Rise Above the Fear

Rise Above the Fear

Hold onto your hats, because we’re about to debunk the notion that high-interest rates are the ultimate villain in the world of property investment. While the uneducated may be telling you that it is the worst time ever to be investing in property, we’re here to reveal why this so-called “worst time” to invest in property is secretly the best-kept secret for savvy investors. So, get ready to unleash your inner Sherlock Holmes as we uncover the hidden treasures of the real estate market, defying the odds and showing you why now is the perfect time to dive headfirst into property investment.

After a challenging period, the industry has made a remarkable comeback, reaching pre-pandemic levels of growth in the last quarter of the previous year. What is even better news is that this positive trend has continued into the first quarter of 2023 – which is great news for property investors.

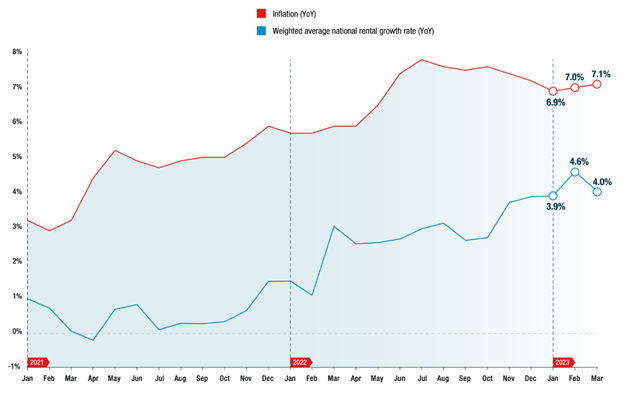

From the start of the year until March, rental growth recorded impressive rates of 3.9%, 4.6%, and 4%, respectively each month. Despite these promising figures, it is important to note that inflation has remained stubbornly high, with rates of 6.9%, 7%, and 7.1% during the three-month period.

Source: PayProp

Despite multiple interest rate increases implemented thus far, inflation remains unyielding, although it has slightly decreased from its peak last year. This persistence of high inflation rates has led to a challenging situation, with rising prices and increased debt repayments further squeezing tenant affordability. However, amidst these difficulties, higher-earning individuals find themselves unable to afford home purchases due to the rising interest rates, leading to a surge in demand for rental properties. This is GREAT news for property investors, not just because the demand is high for rental properties, but because the property sales market also becomes saturated, which means you can get incredible deals on properties.

Still not convinced that now is the best time to be investing in property?

As anticipated, the Western Cape also maintains its position with the highest average rent in South Africa, currently standing at R9,872, an increase from R9,737 in the previous quarter. Impressively, rents in the province have experienced a year-on-year growth rate of 5.0%, surpassing the average. This upward trend suggests that the average rent in the Western Cape reaching the five-figure mark this year.

Against all odds presented by the current economic landscape, the residential rental sector has emerged as a resilient force, defying expectations and showcasing impressive performance. With rental growth reaching its highest point in five years, it’s clear that the market is experiencing a surge of positive momentum. From the first quarter of 2022 to the first quarter of 2023, eight out of nine provinces in South Africa witnessed encouraging rental growth, signifying a widespread trend of stability and prosperity.

Despite the challenges over the past couple of years, the residential rental sector continues to display its resilience and offers promising opportunities for investors and tenants alike.

Get the basics in place first

Before you rush off to start building or expanding your property portfolio, you need to make sure your foundations are right and ready, which means having the correct structures in place to build and manage your portfolio. We will once again, after massive demand, be hosting our full-day in-person seminars across South Africa, where we will show you how to set up the correct structures to protect your property investments, keeping them 100% safe from hostile creditors. Seats are very limited, so to book your spot, click on the link below and let us help you learn how you can make money with property.

To book visit www.wealthmastersclub.com/seminars