Taxes are FUN!

Taxes are FUN!

I know what you’re thinking. Can two words be used in the same sentence without causing a grammatical catastrophe? My friends, prepare to turn your tax-loving world upside down.

Let’s face it, tax is never usually seen as fun! Whether you are talking about it, planning for it, and particularly when you have to pay for it.

So, let’s dive into some of the crucial points you need to remember for the upcoming tax season.

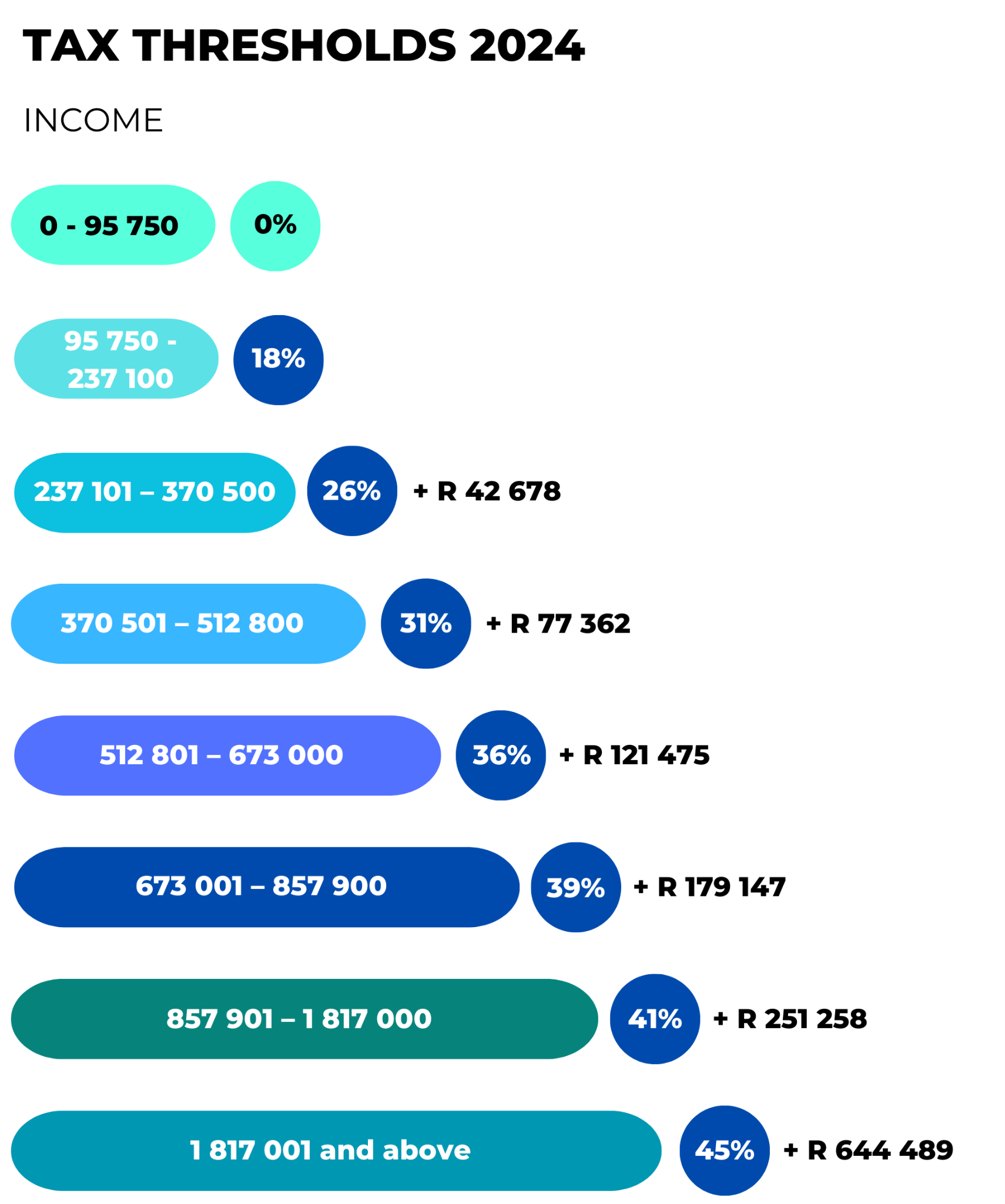

2024 TAX THRESHOLDS

In response to changing economic circumstances, the South African Revenue Service (SARS) has adjusted the tax thresholds for the current year. These revised rates aim to ensure fair and proportionate taxation by accommodating the changing financial landscape. SARS’s approach reflects its commitment to maintaining a balanced and equitable tax system that caters to the needs of individuals and businesses… or at least that’s what they say.

The new tax thresholds look like this.

How is this fun? With the right team, structure, and investment method, you can reduce your tax liability – even down to ZERO. How? Keep reading!

THE OTHER CHANGES

Ok, I admit, it might not ALL be fun when it comes to the changes implemented by SARS for the new financial year, but a smart and savvy investor needs to understand tax implications or at least have the right accountant who can make sure they are taking advantage of all the new changes in place.

- Home office expense deductions are no longer permitted by SARS for salaried employees, only independent contractors and commission earners who have a home office can now claim this benefit. Even if your company has allowed you to work from home, salaried employees are no longer able to claim this benefit – sorry!

- Tax season has been confirmed to start on the 1st of July and will remain open until the 4th of December – but this doesn’t mean you can take it easy. The sooner you can handle your tax affairs, the sooner you can start planning for your next financial year. And you don’t want to have to start your December with SARS letters.

- Tax certificates (such as medical certificates, donations, fund contributions, etc.) are still of utmost importance when submitting your returns to be sure you are 100% compliant and able to provide the necessary documentation in the event of being audited.

WHERE’S THE FUN?

Right, so you’ve read about the serious points; now let me tell you about the fun. Imagine you didn’t pay taxes and wouldn’t even have to go to jail. Imagine using that money to do anything you like – go on holiday, invest into a passive income, spoil the family.

Now it’s getting fun, right?

At the Wealth Masters Club, that is what we do. We help ordinary South Africans create the correct structures to protect and grow their assets while making sure they are paying as little unnecessary tax as possible.

How do we do it? It’s pretty simple, more than two decades of working with the top experts in SA law and accounting practices. If you are part of our exclusive club, you can also access these experts and methods. And to get involved is simple – you have until the end of this month to register for our FREE online training, which will give you a taste of what we do and how we do it. If you like what you see and would like to have one of our experts help you, we will even give you a FREE consultation with one of our expert Wealth Officers.

We have spent the last two decades doing the hard work so that you can enjoy the benefits of loving taxes… because you won’t have to pay them.

Register for one of our training sessions today: